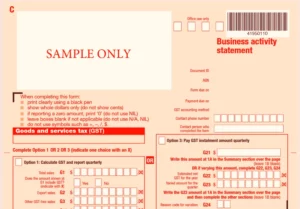

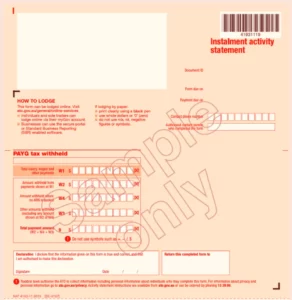

Business Tips

Going digital

There are so many reasons to “Go Digital”, with “cloud accounting” and Work From Home orders. there are few and little reason not to. But i know that there are a lot of businesses choosing not to for one simple reason; its daunting.